Are you familiar with the principle of WAQF?

July 27, 2020The “WAQF” or “Habous” has been a pillar of the Islamic economy since the origin of Islam. WAQF is an Arabic term composed of two concepts: “Habous”, which refers to immobilization, the suspension of property rights, and “Tasbil”, which refers to reserving the use and benefits of an immobilized asset for charitable purposes.

The WAQF thus designates the immobilization of an asset for charitable and public

purposes, whose economic return must be spread over a long period of time, from year to

year. Assets or capital tied up in productive investment mediums generate income to be

distributed to the beneficiaries mentioned by the founder, or allocated to development

projects, particularly humanitarian or spiritual.

Investment principles

- Participation in profits and losses

- Prohibition of Excessive Risk

- The prohibition of interest or usury

- Backing of real assets

- Prohibition of speculative practices

- A ban on investment in companies whose activities are harmful to man and society (tobacco, arms, gambling, etc.).

- Investment in activities that do not cause any harm to the environment

The conditions

- The goods must provide sustainable income for charitable purposes or support to

persons or types of persons identified by the founder.

- Investments must be consistent with the wishes and intentions of the donors.

- WAQF's foundation market transparency in terms of activities.

- Investments must not present a high risk, in order to avoid the loss of the WAQF's capital assets.

Assets put into WAQF

They must be lawful and capable of producing income. They are generally of private origin and are subject to a precise legal framework, agreed in advance and formally drafted.

Beneficiaries

They are predetermined in a wide range of variants. For example, if the beneficiary is religious, charitable or public, it is a “khayrî foundation”. The WAQF can also be of a private family nature. In this case, it is an “ahlî” or “dhurrî waqf”.

The donor's commitment

The contract must be immediately operational, cannot be based on an evasive promise and must not include a condition that contradicts the principles of the WAQF.

The administrator of the WAQF

He has no right to the ownership of the fixed asset or its usufruct and cannot sell it as long as it is profitable. If profits decrease to the extent that they no longer meet the needs of the beneficiaries, it may be exchanged for another, more productive asset.

The charitable WAQF

The advantage of the WAQF is its stability and durability, due to its principle of

investment and distribution of the product of the return, and not of the capital tied up.

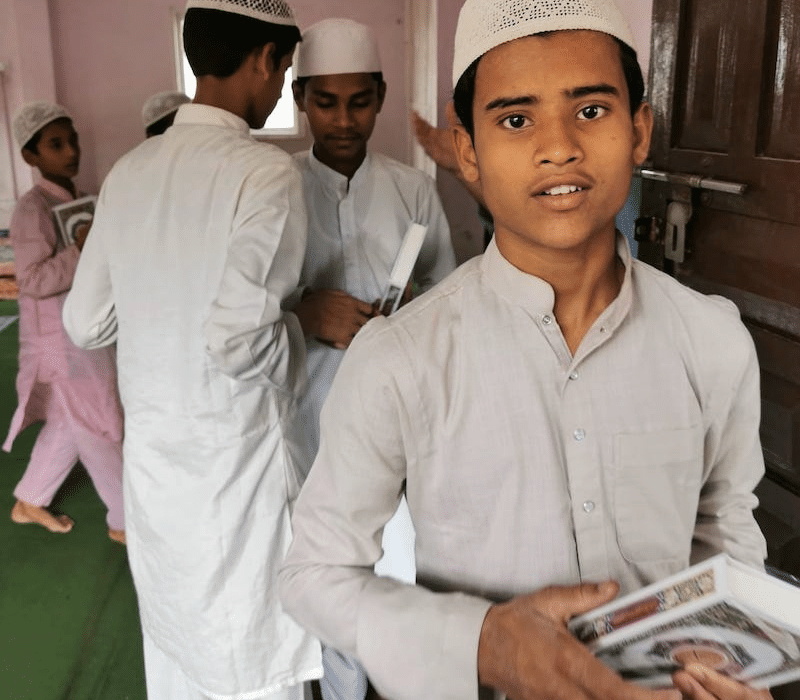

The charitable WAQF is a device whose income is earmarked for charities, for the benefit

of needy people or for projects of general interest, such as places or equipment for

worship and education. The income of the WAQF can be used to fund schools and “Madrasas”.

The earliest examples date back to the ninth century when the WAQFS financed the first

religious “Madrasah” schools in Nichapur, Iran, and later in most Muslim countries.

Offer the Holy Qur’an, medicine for the soul

The crisis of COVID-19 came on suddenly, abruptly interrupting human activity and threatening the health of millions of us. This ordeal reminds us of our vulnerability and the fragility of our existence, in the face of phenomena that are beyond our scope and know no boundaries.

More